Business Operations with Integrated Accounting: A Guide to Odoo’s Hidden Work

In today’s dynamic business landscape, integrating accounting seamlessly into your workflow brings numerous benefits, empowering you to make efficient and informed management decisions.

Throughout the article, we’ll explore the various stages of:

- Sales flow

- Purchase flow

- Receipt of goods

- Manufacturing

- Delivery of goods

- Invoicing

- Payments

Through the practical example, you’ll discover the seamless integration of accounting in Odoo and its ability to provide real-time, accurate data for effective financial management in your organization.

Note: Consider an automated inventory valuation for an Anglo-Saxon accounting system [US].

Check this Article: What Exactly is Odoo?Sales

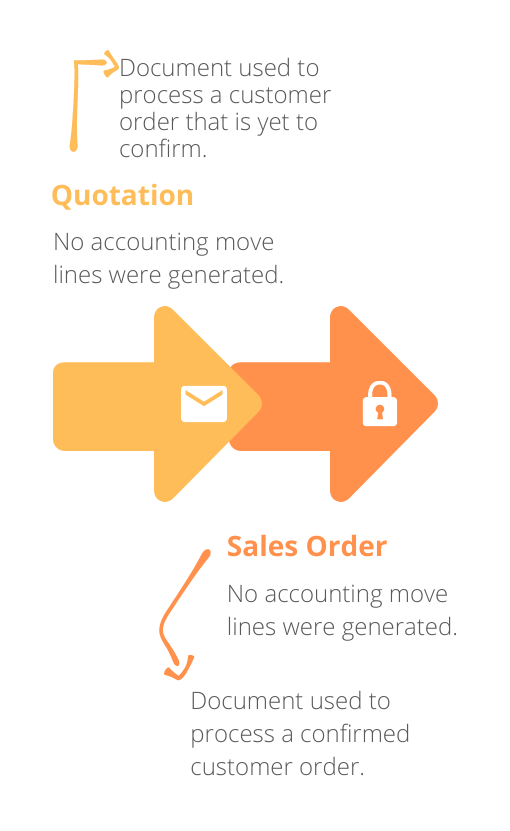

The sales flow in Odoo encompasses three key stages:

- Quotation - A flexible document used for negotiations between your company and the customer.

- Quotation Sent - Keeps track of communication, ensuring ongoing contact with the client.

- Sales Order - The official order document that finalizes the negotiation process between both parties.

Throughout the sales process, Odoo does not record any accounting information until the Invoice is confirmed. However, the Sales Analysis report system in Odoo provides valuable insights that enable informed short-term decision-making.

Purchase

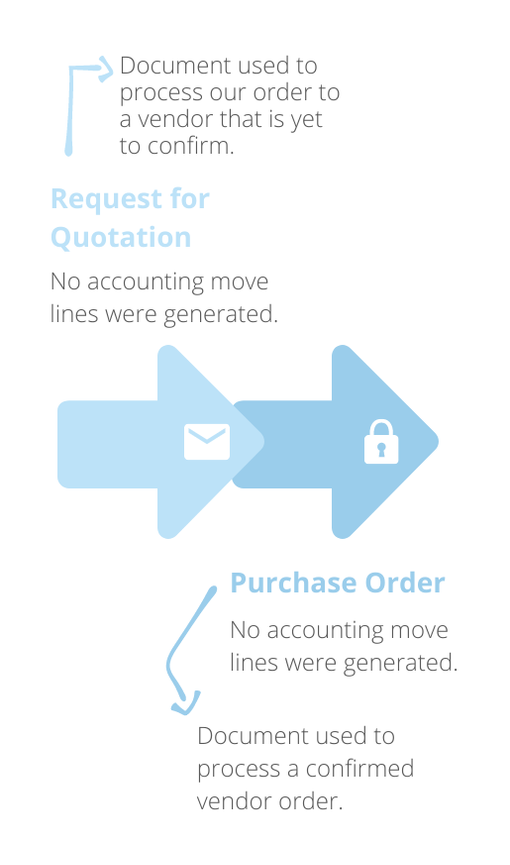

Similar to the sales flow, Odoo’s purchase flow consists of three equivalent stages:

- Request for Quotation - A flexible document used for negotiations between your company and the vendor.

- RFQ sent - Keeps track of communication, ensuring ongoing contact with the vendor.

- Purchase Order - The official order document that finalizes the negotiation process between both parties.

Again, these documents don’t generate accounting moves. However, Odoo’s Purchase Analysis reporting system is quite efficient to provide provisional data to consolidate any management decisions.

Purchase Order Clearing & Sale Order Clearing Accounts

The Clearing or Stock Interim Accounts are suspense accounts for inventory valuation. They serve as storage spaces for the value of goods that have not been billed (for received goods) or invoiced (for delivered goods) until corresponding bills or invoices are created and confirmed.

This mechanism ensures the following in your accounting system:

- Accurate tracking of inventory value throughout the billing and invoicing processes

- Maintaining consistency

- Maintaining precision

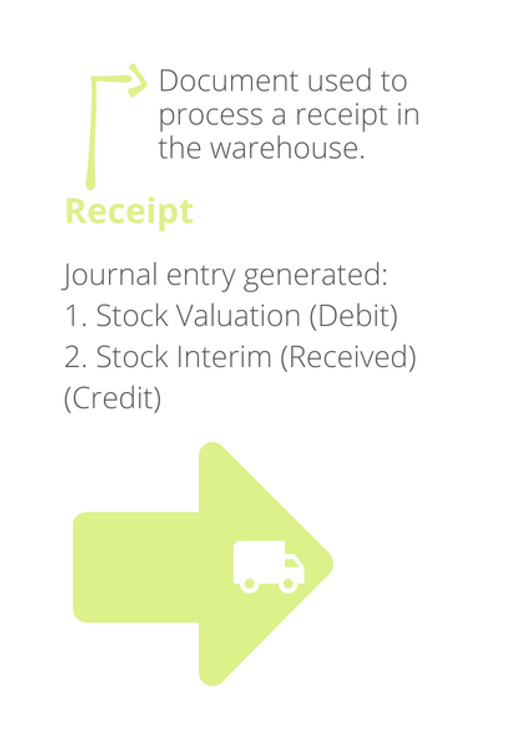

Receipt

The receipt of goods marks a crucial phase in the purchase flow, as it affects inventory and accounting. At this stage, the items become available in the warehouse, impacting the accounting system by increasing the Stock Valuation account and adding the goods to the Stock Interim (Received) account.

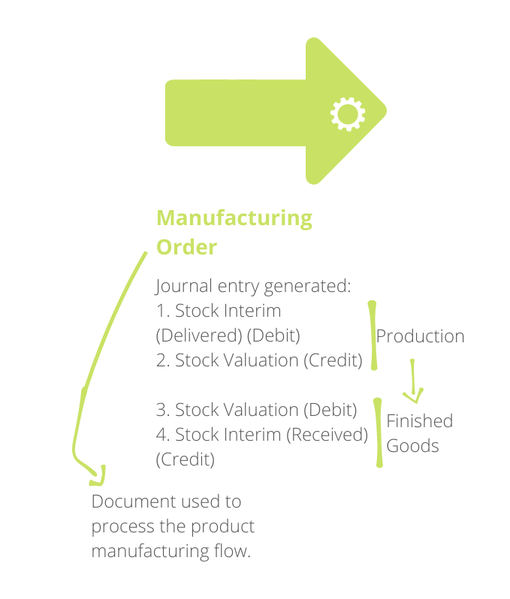

Manufacturing

Once the required products are received in the warehouse, the manufacturing process can commence. In Odoo, manufacturing orders (MO) go through four stages, each playing a significant role in ensuring smooth operations and accurate financial tracking.

Stage 1 :Draft

The manufacturing order starts in the draft stage, where all is prepared and planned before moving forward.

Stage 2 :Confirmed

Once the manufacturing order is confirmed, the production of the finished goods is initiated. At this stage, the system creates a journal entry, recording the production process.

In addition, Odoo proportionately reduces the Stock Valuation account based on the components to be consumed, while it also places the corresponding value in the “Stock Interim (Delivered)” account.

Major Odoo benefit: This tracking allows you to monitor works-in-progress on your shopfloor.

Stage 3 :In Progress

Even if the components are only consumed when the Manufacturing Order (MO) is marked as “Done”, Odoo ensures that these components are reserved. It will also exclusively allocate it to the specific manufacturing order, preventing their multiple consumptions in different orders.

Major Odoo benefit: This allocation guarantees accuracy and prevents any discrepancies.

Stage 4 :Done

Upon marking the manufacturing order as done, the system records an adjustment entry. This entry rewrites the Stock Valuation account with the valuation of the finished goods. It, therefore, finalizes the manufacturing process and updates the accounting system with the accurate value of the finished goods.

Check this Article: Odoo for Manufacturing

Delivery

The completion of the flow culminates in the delivery of the products. Confirming the delivery order leads to:

- Decrease in stock quantities

- Corresponding decrease in the Stock Valuation account due to the sale of items

Invoicing

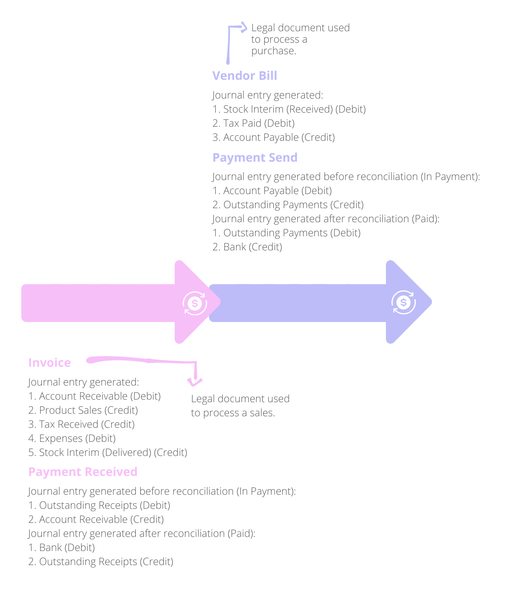

Invoicing involves generating two key documents:

- The Invoice

- Vendor Bill

Depending on your company’s workflow, invoices and bills can be raised at the beginning, during or at the end of the processes (sales and purchase).

When it comes to issuing customer invoices, Odoo understands the importance of accommodating diverse payment terms with different companies. For this reason, Odoo provides two distinct invoicing options:

Full Invoicing

The full invoice, also referred to as the regular or final invoice, is the traditional method of invoicing in Odoo. It encompasses the complete payment amount due by the customer, considering the agreed-upon terms and conditions. It’s also the document that generates the entry where the income, expense, taxes, receivables, and stock valuation will be counted.

Partial Invoicing

In recognition of the need for flexibility, Odoo offers the option of issuing partial invoices, known as down payments or deposits. This feature allows you to request a portion of the total sale order amount upfront, providing greater convenience for both parties involved.

Payment

You can specify the down payment as a fixed amount or a percentage of the total sale order value. The system will deduct it from the regular invoice once created.

In addition to the Down Payment, Odoo automatically creates a specific product upon the first down payment, which you can configure according to your requirements, enabling you to set the prepayment accounts for both customers and vendors.

For billing purposes, Odoo does not have a default system for managing prepayments. However, there are community modules available to address this need. Feel free to book a consultation with us to explore these options for your company.

The flow is considered complete when payments, received or sent, are registered on each fiscal document, allowing you to maintain control over partner balances and bank statuses.

Conclusion

With Odoo’s seamless integration of accounting processes, you gain immediate access to real-time and accurate data with a simple click. This automation not only saves time but also empowers you to make well-informed decisions for your business.

In a competitive business, ensure you have an advantage in every aspect of your company! Experience the power of integrated accounting in Odoo and elevate your operational efficiency today.

Start Your Project Now